Bitcoin Options

Options ·While Bitcoin markets have progressed quite a bit over the past few years, there is one aspect that has not gained enough traction as of yet.

These are Bitcoin option markets.

This is unfortunate mainly due to the fact that Options are a great way to trade assets that exhibit high levels of volatility. They are also ideal instruments to use for managing the risk in a portfolio.

While the market is limited, there are, however, a few places that you can trade these instruments in either a physical or synthetic form.

In this post, we will take a quick look at these as well as how you can trade them.

Options 101

Before we can take a look at some Bitcoin options, we have to give you a quick overview of what financial options are and how they work.

Options are derivative instruments that give the holder the right but not the obligation to buy or sell an asset at some predetermined time in the future.

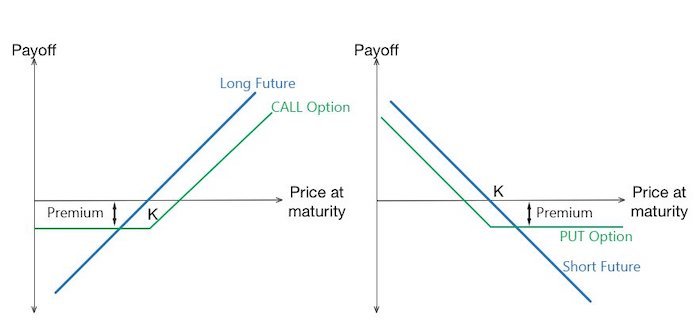

Given that there is this optionality in the payoff, it is asymmetric. Unlike with futures, they do not have a continual linear payoff in gains/losses. Below is a CALL and PUT option payoff compared to a long and short futures contract.

What is clear from the above is that the options allow the trader to cap their losses. In this case, the loss that the trader can incur is limited to the cost of the option (option premium).

Now that you have an idea of how options function, let’s take a look at some of the best places to trade them.

LedgerX

The most reputable Bitcoin derivatives exchange is LedgerX.

LedgerX is the only US regulated spot and options exchange for Bitcoin.

They are a United States CFTC regulated trading platform for physically-settled digital currency derivatives

They offer a range of strikes from $2,000 to $50,000 for terms that expire out to 2020.

A range of options — unlimited possibilities.

LedgerX is the first federally regulated exchange and clearing house to list and clear fully-collateralized, physically-settled bitcoin swaps and options for the institutional market. The U.S. Commodity Futures Trading Commission (CFTC), which regulates virtual currency derivatives, oversees LedgerX's registration as a swap execution facility (SEF) and derivatives clearing organization (DCO).

The LedgerX management team comprises Goldman Sachs, MIT and CFTC alumni, who bring financial expertise, technical talent and regulatory experience to the firm. Ananda Radhakrishnan, former Director of the CFTC’s Division of Clearing and Risk and current Vice President of the Center for Bank Derivatives Policy at American Bankers Association, and Carl Mahler, Partner at Gelber Group, currently sit on the LedgerX Board of Directors. Mark Wetjen, Managing Director at Depository Trust Clearing Corp (DTCC) and former Commissioner of the CFTC, currently sits on the board of directors of Ledger Holdings Inc., the parent company of LedgerX.

On May 22, 2017, Ledger Holdings Inc. announced the closing of $11.4 Million in Series B financing led by Miami International Holdings Inc. and Huiyin Blockchain Venture Investments. Early investors include Google Ventures and Lightspeed Venture Partners.

BitMEX

Although the BitMEX exchange is mostly known as a futures exchange, they have a unique futures contract called the 'limited loss' contract.

These are basically futures contracts that have a defined maximum loss that the trader will take before their position is immediately liquidated.

This is different from traditional futures markets where instead of a liquidation, you will get a margin call. If you cannot meet your margin call then you are still liable for losses. It is this reason the standard futures contracts can be considered so risky.

When you place a trade on BitMEX, you will put up an initial margin for the position. This margin can be considered analogous to the option premium that you would spent on a traditional Bitcoin option.

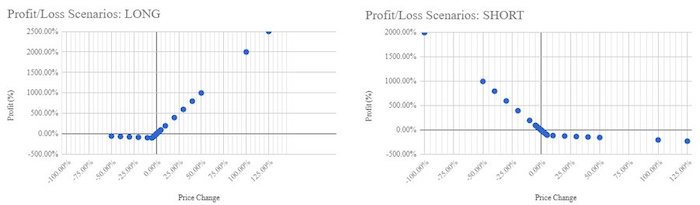

If the price of the futures contract goes against your position then the BitMEX liquidation engine will be sure to close out your position before it eats away at the rest of your capital. Below is an image of the payoff profile of the BitMEX limited risk futures.

While these futures contracts may seem like an attractive instrument, they are still not pure option instruments. They may not react to volatility adjustments and other market factors as well as traditional options do.

Deribit Exchange

If you have actively being in search of cryptocurrency options then you may have heard of Deribit. They are a relatively small exchange that is based in Amsterdam.

They are also unique as they are one of the only exchanges that list standardized Bitcoin options. Although the volumes are relatively thin and the option notionals are on the lower end, their option order books should be sufficient for most traders.

It works much the same as any other physical Bitcoin exchange in that you are placing an order for an option on Deribit's books. However, unlike with the physical product, there are a number of different options contracts with corresponding order books.

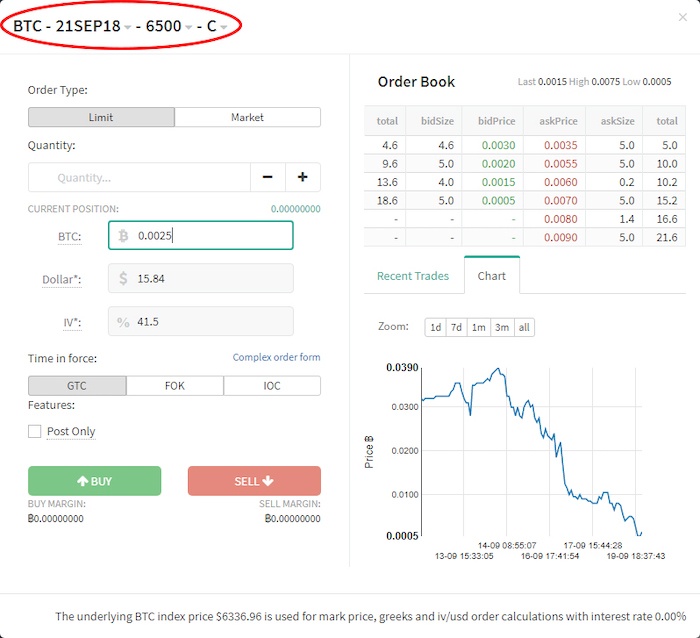

These option markets will differ according to the strike price, the expiry date and whether it is a CALL or a PUT. Below is the order form for a Bitcoin Option on Deribit.

As you can see, you can select the three different inputs in the top left (circled). In this case, it is a 21 Sep 2018 CALL option with a strike price of $6,500. You can see the order books that are currently open for this particular option to the right of that.

In this case, you are placing an order for the price of the option itself. These are all based on the underlying price of Bitcoin at $6,336 at the time. If you adjust any of the option parameters then you will be taken to a new order book.

You may notice that the further away that you take the strike away from the current price, the market may become a bit illiquid. This is mainly as a result of the lack of users who know how to trade options.

If you are a more advanced option trader then you can also place orders based on more specific criteria. These are sometimes called the option Greeks but a discussion of that is beyond the scope of this piece.

Conclusion

We have only just scratched the surface of Bitcoin options trading.

Apart from merely being able to protect portfolios or placing a one-way bet on the price, there a whole host of option strategies that you can employ.

These strategies are used extensively in established option markets and allow the trader to maximize their returns merely based on the underlying volatility in the asset. It is for this reason that many option desks in investment banks are called volatility desks;.

So, could we eventually see Bitcoin volatility desks cropping up?

As Bitcoin faces more Wall Street adoption, you can be certain that portfolio managers will be looking for alternative ways to optimize their portfolios.

I would not be surprised if a thriving Bitcoin option market were to crop up in the next 2-3 years.